Question: In this chapter, you learned about equity financing and in Chapter 10 you learned about debt financing. You are evaluating the financial statements of a

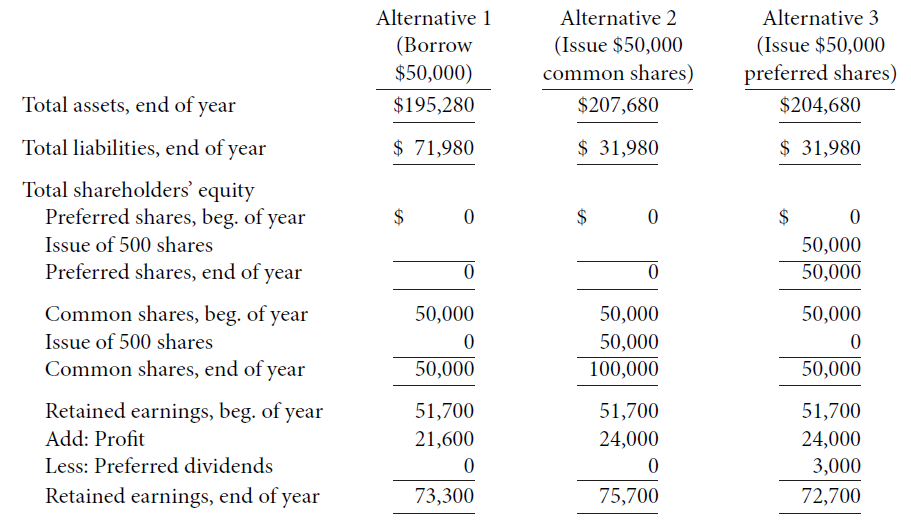

In this chapter, you learned about equity financing and in Chapter 10 you learned about debt financing. You are evaluating the financial statements of a private company that is considering purchasing equipment. You have prepared projected year-end financial statements using three different alternatives: (1) borrow $50,000 at the beginning of the year with repayment terms of $10,000 per year and interest at 6% per year; (2) issue 500 common shares for $100 per share ($50,000 in total) at the beginning of the year; and (3) issue 500 $6 noncumulative preferred shares for $100 per share ($50,000 in total) at the beginning of the year.

Selected information related to each of these three alternatives follows:

Instructions

(a) Using the information provided above, calculate the debt to total assets, return on common shareholders' equity, and earnings per share ratios for each alternative at the end of year.

(b) Based upon your calculations in part (a), which alternative(s) provides for the least amount of debt? Why?

(c) Which alternative provides for the highest return on common shareholders' equity? The highest earnings per share?

(d) If you were a shareholder at the beginning of the year, which alternative would you choose? Why?

(Borrow $205000common shares) preferred shares Total assets, end of year Total liabilitles, end of year Preferred shares, beg. of year Issue of 500 shares Preferred shares, end of year Common shares, beg. of year Issue of 500 shares Common shares, end of year Retaned earnings, beg. of year Less: Preferred dividends Retained earnings, end of year 100,000 2 3 3

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

a Alternative 1 Borrow 50000 Alternative 2 Issue 50000 common shares Alternative 3 Issue 50000 prefe... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1160-B-A-L(6712).docx

120 KBs Word File