Question: In this simulation, you are asked to evaluate a company's solvency and going-concern potential, by analyzing a set of ratios. You also are asked to

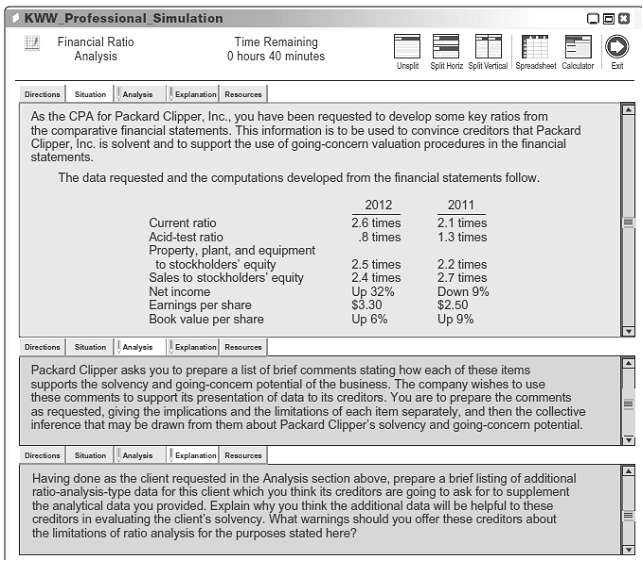

In this simulation, you are asked to evaluate a company's solvency and going-concern potential, by analyzing a set of ratios. You also are asked to indicate possible limitations of ratio analysis. Prepare responses to allparts.

KWW Professional Simulation 2 Financial Ratio Analysis Time Remaining O hours 40 minutes Urspit Spit Horiz Spit Vertical Spreadsheet Calculator Eut Directons Situation Analysia Explanation Resources As the CPA for Packard Clipper, Inc., you have been requested to develop some key ratios from the comparative financial statements. This information is to be used to convince creditors that Packard Clipper, Inc. is solvent and to support the use of going-concern valuation procedures in the financial statements. The data requested and the computations developed from the financial statements follow: 2011 2012 2.1 times 1.3 times 2.6 times 8 times Current ratio Acid-test ratio Property, plant, and equipment to stockholders' equity Sales to stockholders' equity Net income Eamings per share Book value per share 2.5 times 2.4 times Up 32% $3.30 Up 6% 2.2 times 2.7 times Down 9% $2.50 Up 9% Sikuation LAnaiysis Explanation Resources Directions Packard Clipper asks you to prepare a list of brief comments stating how each of these items supports the solvency and going-concem potential of the business. The company wishes to use these comments to support its presentation of data to its creditors. You are to prepare the comments as requested, giving the implications and the limitations of each item separately, and then the collective inference that may be drawn from them about Packard Clipper's solvency and going-concem potential. Direcsions SinuationAnalyaisExplanation Rescurces Having done as the client requested in the Analysis section above, prepare a brief listing of additional ratio-analysis-type data for this client which you think its creditors are going to ask for to supplement the analytical data you provided. Explain why you think the additional data will be helpful to these creditors in evaluating the client's solvency. What warnings should you offer these creditors about the limitations of ratio analysis for the purposes stated here?

Step by Step Solution

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Analysis The currentratio increase is a favorable indication as to solvency but alone tells little about the goingconcern prospects of the client From this ratio change alone it is impossible to know ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-F-R (14).docx

120 KBs Word File