Question: Inbox Software was founded in 1998. Its founder put up $2 million for 500,000 shares of common stock. Each share had a par value of

Inbox Software was founded in 1998. Its founder put up $2 million for 500,000 shares of common stock. Each share had a par value of $.10.

a. Construct an equity account (like the one in Table 14.4) for Inbox on the day after its founding. Ignore any legal or administrative costs of setting up the company.

b. After two years of operation, Inbox generated earnings of $120,000 and paid no dividends. What was the equity account at this point?

c. After three years the company sold one million additional shares for $5 per share. It earned $250,000 during the year and paid no dividends. What was the equity account?

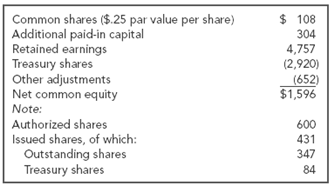

$ 108 Common shares ($.25 par value per share) Additional paid-in capital Retained earnings Treasury shares Other adjustments Net common equity 304 4,757 (2,920) (652) $1,596 Note: Authorized shares Issued shares, of which: Outstanding shares Treasury shares 600 431 347 84

Step by Step Solution

3.50 Rating (167 Votes )

There are 3 Steps involved in it

a b c The day after the founding of ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-F-D (21).docx

120 KBs Word File