Question: Installment-Sales Computation and Entries'Periodic Inventory Mantle Inc. sells merchandise for cash and also on the installment plan. Entries to record cost of goods sold are

Installment-Sales Computation and Entries'Periodic Inventory Mantle Inc. sells merchandise for cash and also on the installment plan. Entries to record cost of goods sold are made at the end of each year. Repossessions of merchandise (sold in 2010) were made in 2011 and were recorded correctly as follows.

Deferred Gross Profit, 2010.................................7,200

Repossessed Merchandise..................................8,000

Loss on Repossession...........................................2,800

Installment Accounts Receivable, 2010............18,000

Part of this repossessed merchandise was sold for cash during 2011, and the sale was recorded by a debit to Cash and a credit to Sales. The inventory of repossessed merchandise on hand December 31, 2011, is $4,000; of new merchandise, $127,400. There was no repossessed merchandise on hand January 1, 2011. Collections on accounts receivable during 2011 were:

Installment Accounts Receivable, 2010.............................$80,000

Installment Accounts Receivable, 2011...............................50,000

The cost of the merchandise sold under the installment plan during 2011 was $111,600. The rate of gross profit on 2010 and on 2011 installment sales can be computed from the information given.

Instructions

(a) From the trial balance and other information given above, prepare adjusting and closing entries as of December 31, 2011.

(b) Prepare an income statement for the year ended December 31, 2011. Include only the realized gross profit in the incomestatement.

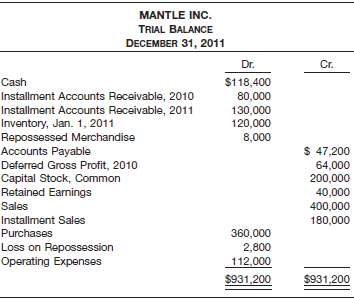

MANTLE INC. TRIAL BALANCE DECEMBER 31, 2011 Dr. Cr. $118,400 Cash Installment Accounts Receivable, 2010 Installment Accounts Receivable, 2011 Inventory, Jan. 1, 2011 Repossessed Merchandise Accounts Payable Deferred Gross Profit, 2010 Capital Stock, Common Retained Earnings 80,000 130,000 120,000 8,000 $ 47,200 64,000 200,000 40,000 400,000 Sales Installment Sales 180,000 Purchases 360,000 Loss on Repossession Operating Expenses 2,800 112,000 $931,200 $931,200

Step by Step Solution

3.32 Rating (164 Votes )

There are 3 Steps involved in it

a Rate of gross profit2010 Deferred gross profit beginning of year 64000 7200 71200 Accounts receiva... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-R-R (87).docx

120 KBs Word File