Question: Installment-Sales Computations and Entries Paul Dobson Stores sell appliances for cash and also on the installment plan. Entries to record cost of sales are made

Installment-Sales Computations and Entries Paul Dobson Stores sell appliances for cash and also on the installment plan. Entries to record cost of sales are made monthly.

The accounting department has prepared the following analysis of cash receipts for the year.

Cash sales (including repossessed merchandise)..........$424,000

Installment accounts receivable, 2010.................................96,000

Installment accounts receivable, 2011...............................109,000

Other........................................................................................36,000

Total.....................................................................................$665,000

Repossessions recorded during the year are summarized as follows.

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 2010

Uncollected balance..............................................................$8,000

Loss on repossession.................................................................800

Repossessed merchandise.....................................................4,800

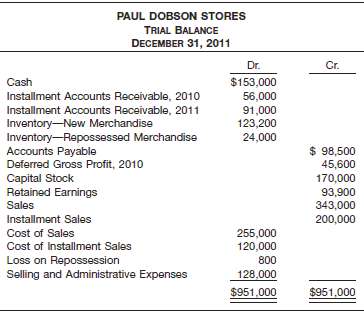

From the trial balance and accompanying information:

(a) Compute the rate of gross profit on installment sales for 2010 and 2011.

(b) Prepare closing entries as of December 31, 2011, under the installment-sales method of accounting.

(c) Prepare an income statement for the year ended December 31, 2011. Include only the realized gross profit in the incomestatement.

PAUL DOBSON STORES TRIAL BALANCE DECEMBER 31, 2011 Cr. Dr. $153,000 Cash Installment Accounts Receivable, 2010 56,000 Installment Accounts Receivable, 2011 Inventory-New Merchandise Inventory-Repossessed Merchandise Accounts Payable Deferred Gross Profit, 2010 Capital Stock Retained Earnings Sales 91,000 123,200 24,000 $ 98,500 45,600 170,000 93,900 343,000 200,000 Installment Sales 255,000 Cost of Sales Cost of Installment Sales 120,000 Loss on Repossession Selling and Administrative Expenses 800 128.000 $951,000 $951.000

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

a Rate of gross profit on 2010 installment sales Deferred gross profit on repossessions 8000 800 480... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-R-R (85).docx

120 KBs Word File