Question: Installment-Sales Computations and Entries Presented below is summarized information for Johnston Co., which sells merchandise on the installment basis. (a) Compute the realized gross profit

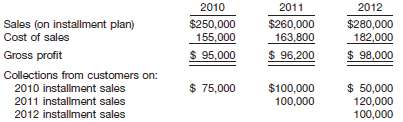

Installment-Sales Computations and Entries Presented below is summarized information for Johnston Co., which sells merchandise on the installment basis.

(a) Compute the realized gross profit for each of the years 2010, 2011, and 2012.

(b) Prepare in journal form all entries required in 2012, applying the installment-sales method of accounting. (Ignore interestcharges.)

2010 2011 2012 Sales (on installment plan) Cost of sales Gross profit Collections from customers on: 2010 installment sales 2011 installment sales 2012 installment sales $260,000 $250,000 $280,000 $ 96,200 $ 98,000 $ 95,000 $100,000 100,000 $ 75,000 $ 50,000 120,000 1

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

a Rate of gross profit Gross profit realized 38 of 75000 38 of 100000 37 of 100000 38 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-R-R (83).docx

120 KBs Word File