Question: An investor is considering two mutually exclusive projects. He can obtain a 6% before-tax rate of return on external investments, but he requires a minimum

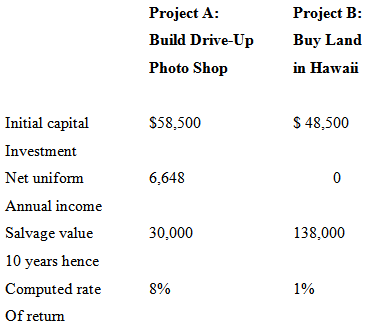

An investor is considering two mutually exclusive projects. He can obtain a 6% before-tax rate of return on external investments, but he requires a minimum attractive rate of return of7% for these projects. Use a 10 year analysis period to compute the incremental rate of return from investing in Project A rather than

Project B.

Project A: Project B: Build Drive-Up Buy Land Photo Shop in Hawaii $ 48,500 Initial capital $58,500 Investment Net uniform 6,648 Annual income Salvage value 30,000 138,000 10 years hence Computed rate 8% 1% Of retum

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

5 6648 0 6648 50 1193 600 root 6 6648 0 6648 60 3 7 6648 0 6648 70 1086 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (177).docx

120 KBs Word File