Question: It is December 2012, and Sharon Sowers, the CEO of Mallory Services, has decided to sell the clerical division. She has received an offer for

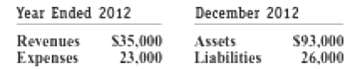

It is December 2012, and Sharon Sowers, the CEO of Mallory Services, has decided to sell the clerical division. She has received an offer for $ 105,000 but is undecided about whether she wishes to complete the sale in 2012 or 2013. She is currently evaluating the effects of the sales on 2012 reported net income. Income from continuing operations for 2012 is estimated to be $950,000 (excluding the activities of the clerical division), and information about the clerical division is provided as follows. The company's tax rate is 35 percent.

(a) Prepare the 2012 income statement, beginning with net income from continuing operations. Assuming that Sharon accepts the offer, and explain how a user might interpret the items on the income statement in terms of earning persistence.(b) Prepare the 2012 income statement, beginning with net income from continuing operations, assuming that Sharon chooses not to sell the division in 2012, and explain how a user might interpret the items on the income statement in terms of earnings persistence.(c) Describe some of the important trade-offers Sharon faces as she decides whether to complete the sale in 2012 or2013.

Year Ended 2012 December 2012 Revenues Assets Liabilities S35,000 23.000 $93,000 26,000 Expenses

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

a Mallory Services Income Statement For the Year Ended December 31 2012 Income from continuing operations before taxes 950000 Income tax expense 33250... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-M-A-S-C-F (113).docx

120 KBs Word File