Jerry Mak, a certified public accountant, has just given his employer Kevin Roll, the president of Roll

Question:

Jerry Mak, a certified public accountant, has just given his employer Kevin Roll, the president of Roll Print Gallery, Inc., the following income statement.

Roll Print Gallery, Inc.

Income Statement

For the Year Ended December 31, 2011

Sales …………………………………………… $884,000

Cost of goods sold ……………………………. 508,000

Gross margin ………………………………….. $376,000

Operating expenses (including depreciation

expense of $20,000) …………………………. 204,000

Operating income ……………………………. $172,000

Interest expense ……………………………... 24,000

Income before income taxes ………………… $148,000

Income taxes expense ……………………….. 28,000

Net income ………………………………….. $120,000

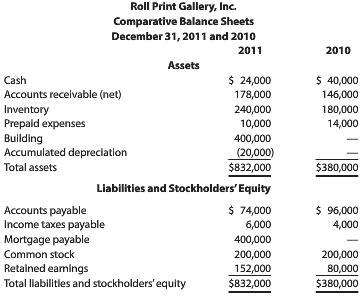

After examining the statement, Roll said to Mak, “Jerry, the statement seems to be well done, but what I need to know is why I don’t have enough cash to pay my bills this month. You show that I earned $120,000 in 2011, but I have only $24,000 in the bank. I know I bought a building on a mortgage and paid a cash dividend of $48,000, but what else is going on?” Mak replied, “To answer your question, we have to look at comparative balance sheets and prepare another type of statement. Take a look at these balance sheets.” The statement handed to Roll follows.

1. To what other statement is Mak referring? From the information given, prepare the additional statement using the indirect method.

2. Roll Print Gallery has a cash problem despite profitable operations. Explain why.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: