Question: Job costing with multiple direct-cost categories, single indirect-cost pool, law firm Hanley asks his assistant to collect details on those costs included in the $21,000

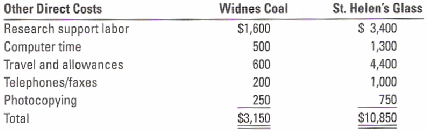

Job costing with multiple direct-cost categories, single indirect-cost pool, law firm Hanley asks his assistant to collect details on those costs included in the $21,000 indirect-cost pool that can be traced to each individual job. After analysis, Wigan is able to reclassify $14,000 of the $21,000 as direct costs:

Hanley decides to calculate the costs of each job as if Wigan had used six direct cost-pools and a single indirect-cost pool. The single indirect-cost pool would have $7,000 of costs and would be allocated to each case using the professional labor-hours base.

1. What is the revised indirect-cost allocation rate per professional labor-hour for Wigan Associates when total indirect costs are $7,000?

2. Compute the costs of the Widnes and St. Helen’s jobs if Wigan Associates had used its refined costing system with multiple direct-cost categories and one indirect-cost pool.

3. Compare the costs of Widnes and St. Helen’s jobs in requirement 2 with those in requirement 2 of Problem 5-28. Comment on the results.

Widnes Coal St. Helen's Glass Other Direct Costs Research support labor Computer time Travel and allowances Telephones/faxes Photocopying Total $1,600 500 600 200 250 S 3,400 1,300 4,400 1,000 750 $3,150 $10,850

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Job costing with multiple directcost categories single indirectcost po... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-C-P-A (179).docx

120 KBs Word File