Question: Kellogg Company is the world??s leading producer of ready-to-eat cereal products. In recent years, the company has taken numerous steps aimed at improving its profitability

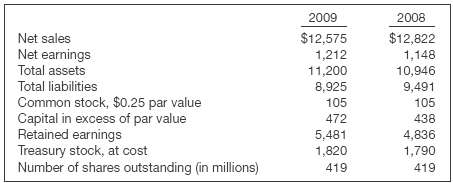

Kellogg Company is the world??s leading producer of ready-to-eat cereal products. In recent years, the company has taken numerous steps aimed at improving its profitability and earnings per share. Presented below are some basic facts for Kellogg.

Instructions(a) What are some of the reasons that management purchases its own stock?(b) Explain how earnings per share might be affected by treasury stock transactions.(c) Calculate the ratio of debt to total assets for 2008 and 2009, and discuss the implications of thechange.

2009 2008 $12,575 $12,822 1,148 10,946 9,491 Net sales Net earnings Total assets Total liabilities Common stock, $0.25 par value Capital in excess of par value Retained earnings Treasury stock, at cost Number of shares outstanding (in millions) 1,212 11,200 8,925 105 105 472 438 5,481 1,820 4,836 1,790 419 419

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

a Management might purchase treasury stock to provide to stockholders a taxefficient method for rece... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-S-H (208).docx

120 KBs Word File