Krystal is a U.S.-based company which manufactures, sells, and installs water purification equipment. On April 11th the

Question:

Krystal is a U.S.-based company which manufactures, sells, and installs water purification equipment. On April 11th the company sold a system to the City of Nagasaki, Japan, for installation in Nagasaki's famous Glover Gardens (where Puccini's Madame Butterfly waited for the return of Lt. Pinkerton.) The sale was priced in yen at ¥20,000,000, with payment due in three months.

Spot exchange rate:..................¥118.255..........¥118.255/$ (closing mid-rates)

One-month forward rate:............¥117.760.........................................5.04%

Three-month forward:.................¥116.830........................................4.88%

One-year forward: ...................¥112.450........................................5.16%

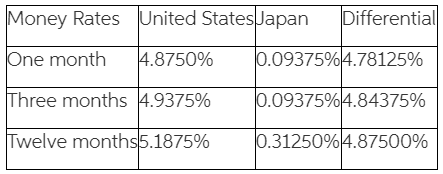

Additional information: Aquatech's Japanese competitors are currently borrowing yen from Japanese banks at a spread of 2 percentage points above the Japanese money rate. Aquatech's weighted average cost of capital is 16%, and the company wishes to protect the dollar value of this receivable.

Three-month options from Kyushu Bank:

* Call option on ¥20,000,000 at exercise price of ¥118.00/$: a 1% premium.

* Put option on ¥20,000,000, at exercise price of ¥118.00/$: a 3% premium.

a) What are the costs and benefits of alternative hedges? Which would you recommend, and why?

b) What is the breakeven reinvestment rate when comparing forward and money market alternatives?

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Multinational Business Finance

ISBN: 978-0133879872

14th edition

Authors: David K. Eiteman, Arthur I. Stonehill, Michael H. Moffett