Question: Lahmont Bridge Builders built a bridge for the state of Maryland or a two-year period. The contracted price for the bridge was $600,000. The costs

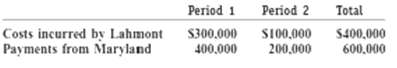

Lahmont Bridge Builders built a bridge for the state of Maryland or a two-year period. The contracted price for the bridge was $600,000. The costs incurred by Lahmont and the payments from the state of Maryland over the two-year period follow.

a. Prepare income statements for Lahmont for the two periods under the following assumptions:(1) Revenue is recognized at the end of the project.(2) Revenue is recognized in proportion to the costs incurred by Lahmont.(3) Revenue is recognized when the payments are received.b. Calculate the total net income over the two-year period under eachassumption.

Period 1 Period 2 Total Costs incurred by Lahmont Payments from Maryland $400,000 $300,000 400,000 S100,000 200,000

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

a 1 Revenue recognized at the end of the project Lahmont Bridge Builders Income Statement For the Pe... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-F-S (461).docx

120 KBs Word File