Question: Learning about bonds may seem overwhelming at first. Lets review information on the InvestinginBonds.com website (www.investinginbonds.com) and look at some examples. Click See Corporate Market

Learning about bonds may seem overwhelming at first. Let’s review information on the InvestinginBonds.com website (www.investinginbonds.com) and look at some examples. Click See Corporate Market At-A-Glance on the home page. Then under “Show Me Corporate Price Data,” click Most active bonds during the last trading day to find information on corporate bond issues. After working through the following problems, understanding bonds may not seem quite so complicated!

1. Can you tell from the information provided whether the bonds are selling at a premium or a discount? If so, how can you tell?

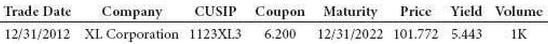

Assume that the following fictional bond is listed at InvestinginBonds.com and that interest is paid semiannually:

- CUSIP is a unique number used to identify a specific bond. The acronym stands for the Committee on Uniform Security Identification Procedures.

- Coupon is the rate of interest payable annually.

- Yield is the annual return you earn on the bond based on the price you paid and the interest payment you receive.

- Volume is the amount in millions of dollars of a given wholesale transaction. Because K represents 1,000, the 1K size means $ 1 million × 1,000 = $ 1,000,000,000, or $ 1 billion.

2. What is the journal entry to record the issue of this bond on December 31, 2012?

3. What is XL Corporation’s journal entry to record the first semiannual interest payment on June 30, 2013?

4. What is XL Corporation’s adjusting journal entry to record amortization of the bond premium on December 31, 2013? (Use the straight-line method.)

5. How do semiannual interest payments and amortization of the bond premium affect the Interest Expense account?

Trade Date Company CUSIP Coupo Matuity Price Yield Volume 12/31/2012 XL Corporation 23 6.200 12/31/2022 101.772 5.443 K

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

1 You can tell whether bonds are selling at a premium or a discount by the price of the bond Bonds s... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

339-B-A-P (1035).docx

120 KBs Word File