Question: Let's look at Dick's Sporting Goods (Dick's) one last time. Think about Dick's and how everything you've learned comes together. Think about accountants reporting what

Let's look at Dick's Sporting Goods (Dick's) one last time. Think about Dick's and how everything you've learned comes together. Think about accountants reporting what Dick's has, where it got its money, and what it has been doing to create value. Is Dick's earning net income or loss? What resources did Dick's need to operate? Think about the business of Dick's. Return to Dick's Annual Report and look at Dick's financial statements (see the Continuing Financial Statement Analysis Problem in Chapter 2 for instructions on how to access the Annual Report).

Now answer the following questions:

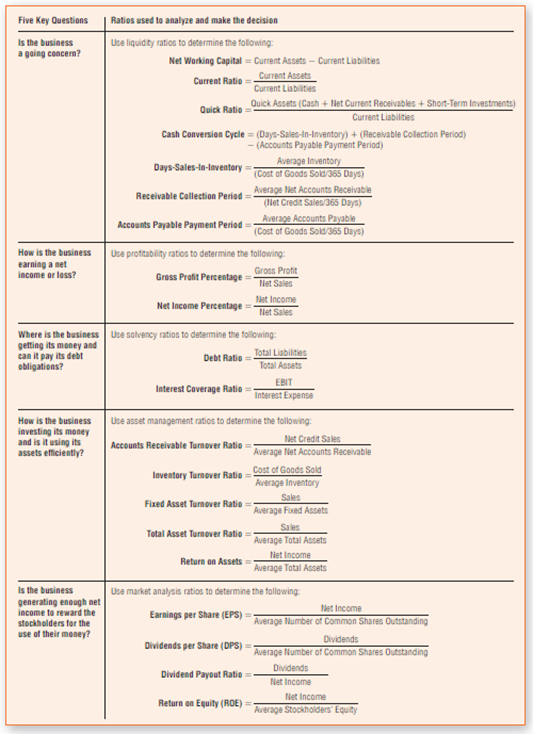

1. Compute the ratios on Exhibit 12-10 for Dick's for the year ending January 31, 2015. Assume all sales are on credit.

2. Compute Dick’s return on equity (ROE) for the year ending January 31, 2015, including the elements of net income/sales, sales/average total assets, and average total assets/average stockholders’ equity. What does this analysis tell you about how Dick’s generates its ROE?

3. What are Dick’s dividends per share and dividend payout ratio for 2014? Why do you think Dick’s pays a dividend? How do you think Dick’s determines the amount of dividend they will pay?

4. Given Dick’s stock price was $51.65 per share on January 30, 2015, what was Dick’s price-earnings ratio (PE) as of that date? If the average PE for companies is 15, what does this tell you the market is saying about Dick’s future?

Five Key Questions Ratios used to analyze and make the decision Use liquidty ratics to determine the following: Is the business a going concern? Net Working Capital = Current Assets - Current Liabilities Current Assets Current Liabilities Current Ratio Quick Ratie Quick Assets (Cash + Net Current Receivables + Short-Term Investments) Current Liabilties Cash Conversion Cycle = (Days-Sales-In-Inventory) + (Receivable Collection Period) - (Accounts Payable Payment Period) Average Inventory (Cost of Goods Sold/365 Days) Days-Sales-ln-lnventory: Average Net Accounts Receivable (Net Credit Sales/365 Days) Receivable Collection Peried = Average Accounts Payable (Cost of Goods Sold/365 Days) Accounts Payable Payment Period = - Use proftability atios to determine the following: Gross Profit Percentage =- How is the business earning a net income or loss? Gross Profit Net Sales Net Income Net Sales Net Income Percentage = Use solvency ratios to determine the following: Where is the business getting its money and can it pay its debt obligations? Total Liabilities Total Assets Debt Ratio = EBIT Interest Expense Interest Coverage Ratio How is the business Use asset management ratios to determine the following: investing its money and is it using its assets efficiently? Net Credit Sales Average Net Accounts Receivable Accounts Receivable Turnover Ratio Inventory Turnover Ratie = Cost of Goods Sold Average Inventory Sales Fized Asset Turnover Ratio Average Fixed Assets Sales Tetal Asset Turnover Ratio= Average Total Assets Net Income Average Total Assets Return on Assets Use market analysis ratios to determine the following: Is the business generating enough net income to reward the stockholders for the Net Income Earnings per Share (EPS) = Average Number of Common Shares Outstanding use of their money? Dividends Average Number of Common Shares Outstanding Dividends per Share (DPS) = Dividends Dividend Payout Ratio =- Net Income Net Income Return on Equity (ROE) = Average Stockholders" Equity

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

1 Amounts in millions except the per share data Text Reference 1 Amount Net Working Capital Current assets Current liabilities Chapter 12 1850384 1118833 731551 Current Ratio Current AssetsCurrent Lia... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (3 attachments)

1350_60b9f89b05d5d_607976.pdf

180 KBs PDF File

1350-B-M-A-I(3653).xlsx

300 KBs Excel File

1350_60b9f89b05d5d_607976.docx

120 KBs Word File