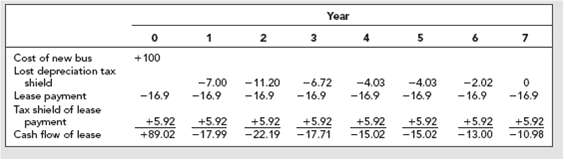

Question: Look again at the bus lease described in Table 26.2. a. What is the value of the lease if Greymare's marginal tax rate is Tc

Look again at the bus lease described in Table 26.2.

a. What is the value of the lease if Greymare's marginal tax rate is Tc = .20?

b. What would the lease value be if Greymare had to use straight-line depreciation for tax purposes?

Year Cost of new bus Lost depreciation tax shield Lease payment Tax shield of lease payment Cash flow of lease +100 --4.03 -6.72 - 16.9 -7.00 -11.20 -4.03 -2.02 -16.9 -16.9 -16.9 -16.9 -16.9 -16.9 +5.92 +89.02 +5.92 +5.92 -17.99 +5.92 -22.19 +5.92 +5.92 +5.92 +5.92 - 17.71 - 13.00 -10.98

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

a b Assume the straightline depreciation is figured on the same basis as the ACRS depreci... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-D-F (55).docx

120 KBs Word File