Question: Look again at the project cash flows in Problem 10. Calculate the modified IRR as defined in Footnote 4 in Section 5.3. Assume the cost

Look again at the project cash flows in Problem 10. Calculate the modified IRR as defined in Footnote 4 in Section 5.3. Assume the cost of capital is 12%.

Now try the following variation on the MIRR concept. Figure out the fraction x such that x times C1 and C2 has the same present value as (minus) C3.

![]()

Define the modified project IRR as the solution of

Now you have two MIRRs. Which is more meaningful? If you can't decide, what do you conclude about the usefulness of MIRRs?

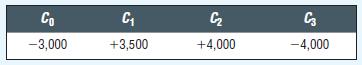

Data from 10.

Calculate the IRR (or IRRs) for the following project:

, C3 xC, + 1.12 1.122

Step by Step Solution

3.48 Rating (171 Votes )

There are 3 Steps involved in it

a b 112 2 xC 1 112xC 2 C 3 x112 2 C 1 112C 2 C 3 Now find MIRR using either trial and er... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

214-B-C-F-P-V (208).docx

120 KBs Word File