Question: Look at Table 28.1. If the three-month interest rate on dollars is 3.5 percent, what do you think is the three-month interest rate on South

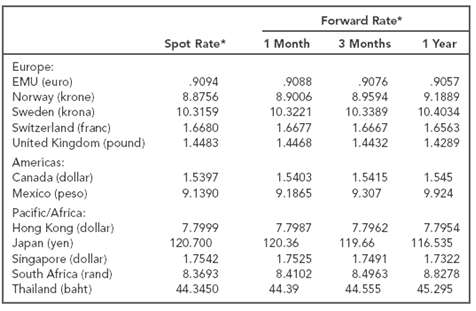

Look at Table 28.1. If the three-month interest rate on dollars is 3.5 percent, what do you think is the three-month interest rate on South African rands? Explain what would happen if the rate were substantially above your figure.

Forward Rate* 1 Month 1 Year 3 Months Spot Rate* Europe: EMU (euro) Norway (krone) Sweden (krona) Switzerland (franc) United Kingdom (pound) 9094 9088 .9076 9057 9.1889 10.4034 8.8756 .9006 .9594 10.3159 10.3221 10.3389 1.6667 1.4432 1.6680 1.6677 1.6563 1.4468 1.4483 1.4289 Americas: 1.545 9.924 Canada (dollar) 1.5397 1.5403 1.5415 Mexico (peso) 9.1390 9.1865 9.307 Pacific/Africa: Hong Kong (dollar) Japan (yen) Singapore (dollar) South Africa (rand) Thailand (baht) 7.7962 7.7954 7.7999 7.7987 120.700 120.36 119.66 116.535 1.7542 1.7525 8.4102 1.7322 1.7491 8.4963 8.8278 8.3693 44.3450 44.39 44.555 45.295

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

We can utilize the interest rate parity theory If the threemonth ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-R-A-M (30).docx

120 KBs Word File