Question: Look back at Table 7.5 and examine the Anadarko Petroleum and Clear Channel bonds that mature in 2017. a. If these companies were to sell

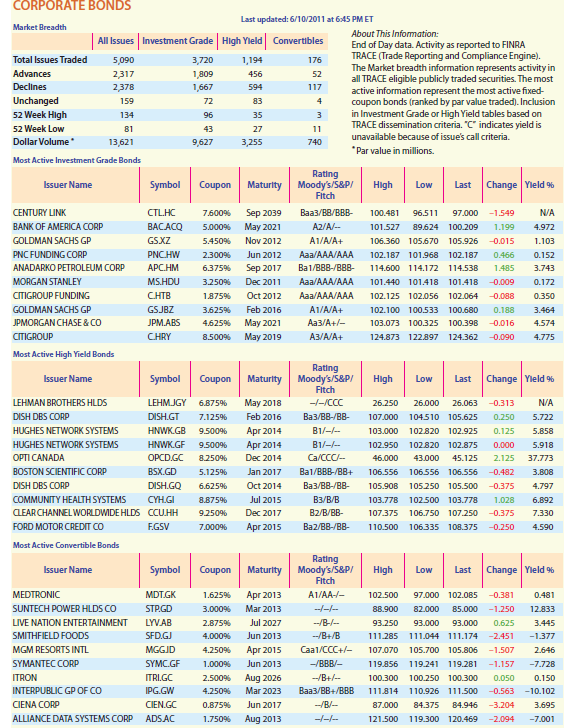

Look back at Table 7.5 and examine the Anadarko Petroleum and Clear Channel bonds that mature in 2017.

a. If these companies were to sell new $1,000 par value long-term bonds, approximately what coupon interest rate would they have to set if they wanted to bring them out at par?

b. If you had $10,000 and wanted to invest in the Anadarko Petroleum bonds, what return would you expect to earn? What about the Clear Channel bonds? Based just on the data in the table, would you have more confidence about earning your expected rate of return if you bought Anadarko Petroleum bonds or Clear Channel bonds? Explain.

Table 7.5

CORPORATE BONDS Last updated: 6/10/2011 at 6:45 PMET Market Breadth About This Information: All Issues Investment Grade Hligh Yleld Convertibles End of Day data. Activity as reported to FINRA TRACE (Trade Reporting and Compliance Engine). The Market breadth information represents activity in all TRACE eligible publicly traded securities. The most active information represent the most active fixed- coupon bonds (ranked by par value traded). Inclusion in Investment Grade or High Yield tables based on TRACE dissemination criteria. "C" indicates yield is Total Issues Traded 3,720 176 5,090 1,194 Advances 2317 1,809 1,667 456 52 Declines 2,378 594 117 Unchanged 159 72 8 52 Week High 134 96 35 11 52 Week Low 81 43 27 unavailable because of issue's call criteria. Dollar Volume 13,621 9,627 3,255 740 *Par value in millions. Most Active Investment Grade Bonds Rating Moody's/S&P/ Fitch Issuer Name Symbol Coupon Maturity High Low Last Change Yleld 9% CENTURY LINK CTLHC Sep 2039 Ba/B/B- N/A 7.600% 100.481 96.511 97.000 -1.549 BANK OF AMERICA CORP BACACQ 5.000% May 2021 A2/A/- 101.527 89.624 100.209 1.199 4.972 GOLDMAN SACHS GP GSXZ 5.450% Nov 2012 A1/A/A+ 106.360 105.670 105.926 -0.015 1.103 PNC FUNDING CORP PNCHW Jun 2012 Aaa/AAA/AAA 2.300% 102.187 101.968 102.187 0.466 0.152 ANADARKO PETROLEUM CORP Sep 2017 Ba1/BB8-/BBB- 114.600 114.172 6.375% 114.538 1.485 3.743 MORGAN STANLEY MS.HDU Dec 2011 Aaa/AAA/AAA -0.009 3.250% 101.440 101.418 101.418 0.172 Oct 2012 CITIGROUP FUNDING CHTB Aaa/AAA/AAA 1.875% 102.125 102.056 102.064 -0.088 0.350 Feb 2016 GOLDMAN SACHS GP GSJBZ A1/A/A+ 3.625% 102.100 100.533 100.680 0.188 3.464 JPMORGAN CHASE & CO JPM.ABS May 2021 /+/- 4.625% 103.073 100.325 100.398 -0.016 4.574 CITIGROUP CHRY May 2019 //A+ 8.500% 124.873 122.897 124.362 -0.090 4.775 Most Active High Yield Bonds Rating Maturity Moody's/S&P/ Fitch Change Yield 9% Issuer Name Symbol Coupon High Low Last LEHMAN BROTHERS HLDS LEHMJGY May 2018 ---/CCC 26.250 N/A 6.875% 26.000 26.063 -0.313 DISH DBS CORP DISH.GT Feb 2016 /-/BB- 7.125% 107.000 104510 105.625 0.250 5.722 HNWK.GB HUGHES NETWORK SYSTEMS Apr 2014 B1/-/- 9.500% 103.000 102.820 102.925 0.125 5.858 HUGHES NETWORK SYSTEMS HNWK.GF Apr 2014 B1/-/- 9.500% 102.950 102.820 102.875 0.000 5.918 OPCD.GC OPTI CANADA Dec 2014 Ca/CCC- 43.000 8.250% 46.000 45.125 2.125 37.773 BOSTON SCIENTIFIC CORP BSX.GD Jan 2017 Ba1/BBB-/BB+ 3.808 5.125% 106.556 106556 106.556 -0.482 Oct 2014 DISH DBS CORP DISH.GQ /-/BB- 6.625% 105.908 105250 105.500 -0.375 4.797 / COMMUNITY HEALTH SYSTEMS CYH.GI Jul 2015 8.875% 103.778 102.500 103.778 1.028 6.892 CLEAR CHANNEL WORLDWIDE HLDS CCUHH Dec 2017 B2/B/BB- %9250 107.375 106.750 107.250 -0.375 7.330 FORD MOTOR CREDIT CO F.GSV Apr 2015 Baz/BB-/BB- 4.590 7.000% 110.500 106335 108.375 -0.250 Most Active Convertible Bonds Rating Moody's/S&P/ Fitch Issuer Name Symbol Coupon Maturity High Low Last Change Yleld 9% MDT.GK MEDTRONIC Apr 2013 A1/AA-- -0.381 1.625% 102.500 97.000 102.085 0.481 STP.GD SUNTECH POWER HLDS CO Mar 2013 --/-I- 88.900 3.000% 82.000 85.000 -1.250 12.833 LIVE NATION ENTERTAINMENT LYV.AB 2.875% Jul 2027 --/B-/-- 93.000 93.250 93.000 0.625 3.445 SMITHFIELD FOODS SFD.GJ Jun 2013 --/B+/B 4.000% 111.285 111.044 111.174 -2.451 -1.377 Caa1/CCC+/- MGM RESORTS INTL MGGJD Apr 2015 4.250% 107.070 105.700 105.806 -1.507 2.646 SYMANTEC CORP SYMC.GF Jun 2013 -/BBB/- 119.241 119.281 1.000% 119.856 -1.157 -7.728 ITRON ITRI.GC IPG.GW Aug 2026 -/B+/-- 2.500% 100.300 100.250 100.300 0.050 0.150 INTERPUBLIC GP OF CO Mar 2023 a/+/BB --0.563 -10.102 4.250% 111.814 110.926 111.500 CIENA CORP CIEN.GC Jun 2017 --/B/- 0.875% 87.000 84.375 84.946 -3.204 3.695 Aug 2013 ALLIANCE DATA SYSTEMS CORP ADSAC ---- 1.750% 121.500 119.300 120.469 -2.094 -7.001

Step by Step Solution

3.43 Rating (182 Votes )

There are 3 Steps involved in it

a According to Table 75 the yields to maturity for Anadarko ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1175-B-F-F-M(8628).docx

120 KBs Word File