Question: Look back to the cash flows for projects F and G in Section 5-3. The cost of capital was assumed to be 10%. Assume that

Look back to the cash flows for projects F and G in Section 5-3. The cost of capital was assumed to be 10%. Assume that the forecasted cash flows for projects of this type are overstated by 8% on average. That is, the forecast for each cash flow from each project should be reduced by 8%. But a lazy financial manager, unwilling to take the time to argue with the projects' sponsors, instructs them to use a discount rate of 18%.

a. What are the projects' true NPVs?

b. What are the NPVs at the 18% discount rate?

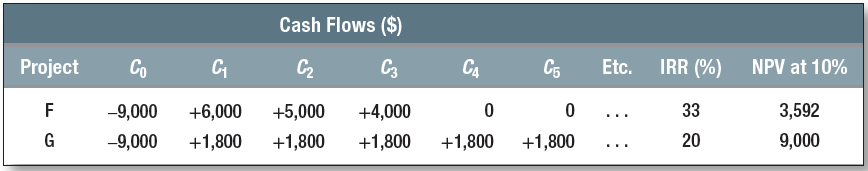

Cash flows for projects F and G

Cash Flows ($) Project IRR (%) NPV at 10% Etc. Co C2 C3 C4 C5 33 3,592 +6,000 -9,000 +5,000 +4,000 20 -9,000 +1,800 9,000 +1,800 +1,800 +1,800 +1,800

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Given data Input variables Project C0 C1 C2 C3 C4 C5 etc ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1084-B-C-F-P-V(739).xlsx

300 KBs Excel File