Question: Luster Electronics Company is analyzing two capital projects, project A and project B. Each has an initial capital cost of $12,000, and the weighted average

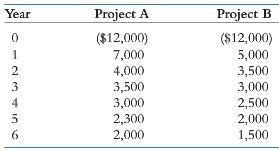

Luster Electronics Company is analyzing two capital projects, project A and project B. Each has an initial capital cost of $12,000, and the weighted average cost of capital for both projects is 12%. The projected annual cash flows are as follows:

1. For each project, calculate the following:

• Payback period

• Net present value

• Internal rate of return

• Profitability index (using the 12% discount rate)

2. Which project or projects should be accepted if the two are independent?

3. Which project should be accepted if the two are mutually exclusive (that is, you can choose only one)?

Year Project A Project B ($12,000) 7,000 4,000 3,500 3,000 2,300 2,000 ($12,000) 5,000 3,500 3,000 2,500 2,000 1,500

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

1 Payback period Year Project A Project B 0 12000 12000 1 7000 5000 2 4000 3500 3 3500 3000 4 3000 2... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

357-B-F-F-M (5389).docx

120 KBs Word File