Marwell plc reported a profit after tax of 14.04m for 20X2 as follows: The statements of financial

Question:

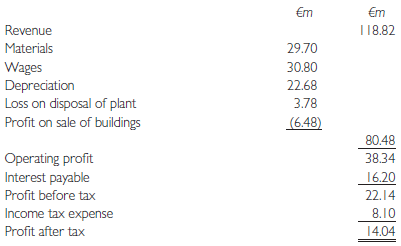

Marwell plc reported a profit after tax of €14.04m for 20X2 as follows:

The statements of financial position and changes in equity showed:

(i) Inventories at the year-end were €5.94m higher than the previous year.

(ii) Trade receivables were €10.26m higher.

(iii) Trade payables were €4.86m lower.

(iv) Tax payable had increased by €2.7m.

(v) Dividends totalling €18.36m had been paid during the year.

Required:

(a) Calculate the net cash flow from operating activities.

(b) Explain why depreciation and a loss made on disposal of a non-current asset are both treated as a source of cash.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting and Reporting

ISBN: 978-1292080505

17th edition

Authors: Barry Elliott, Jamie Elliott

Question Posted: