McGuire Company acquired 90 percent of Hogan Company on January 1, 2010, for $234,000 cash. This amount

Question:

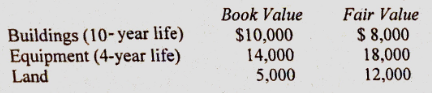

McGuire Company acquired 90 percent of Hogan Company on January 1, 2010, for $234,000 cash. This amount is reflective of Hogan's total fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following:

Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years. The acquisition value attributable to the non-controlling interest at January 1, 2014 is?

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 978-0077431808

10th edition

Authors: Joe Hoyle, Thomas Schaefer, Timothy Doupnik

Question Posted: