Question: Mega Enterprises is in the process of negotiating an extension of its existing loan agreements with a major bank. The bank is particularly concerned with

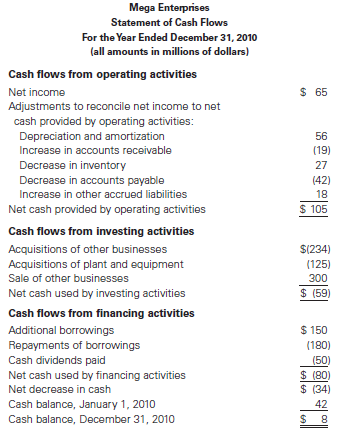

Mega Enterprises is in the process of negotiating an extension of its existing loan agreements with a major bank. The bank is particularly concerned with Mega's ability to generate sufficient cash flow from operating activities to meet the periodic principal and interest payments. In conjunction with the negotiations, the controller prepared the following statement of cash flows to present to the bank:

During 2010, Mega sold one of its businesses in California. A gain of $150 million was included in 2010 income as the difference between the proceeds from the sale of $450 million and the book value of the business of $300 million. The effect of the sale can be identified and analyzed as follows (amounts are in millions of dollars):

Required

1. Comment on the presentation of the sale of the California business on the statement of cash flows. Does the way in which the sale was reported violate GAAP? Regardless of whether it violates GAAP, does the way in which the transaction was reported on the statement result in a misstatement of the net decrease in cash for the period? Explain your answers.

2. Prepare a revised statement of cash flows for 2010 with the proper presentation of the sale of the California business.

3. Has the controller acted in an unethical manner in the way the sale was reported on the statement of cash flows? Explain youranswer.

Mega Enterprises Statement of Cash Flows For the Year Ended December 31, 2010 (all amounts in millions of dollars) Cash flows from operating activities $ 65 Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 56 Increase in accounts receivable (19) Decrease in inventory Decrease in accounts payable 27 (42) Increase in other accrued liabilities 18 $ 105 Net cash provided by operating activities Cash flows from investing activities Acquisitions of other businesses $(234) Acquisitions of plant and equipment Sale of other businesses (125) 300 $ (59) Net cash used by investing activities Cash flows from financing activities $ 150 Additional borrowings Repayments of borrowings Cash dividends paid Net cash used by financing activities (180) (50) $ (80) $ (34) Net decrease in cash Cash balance, January 1, 2010 42 Cash balance, December 31, 2010 8.

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

1 Mega reported the sale of the business by netting the gain against the cash proceeds and thus reporting the book value of 300 million as an investin... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

79-B-M-A-S-C-F (609).docx

120 KBs Word File