Question: Mercury You have been given the task, by one of the partners of the firm of accountants for which you work, of assisting in the

Mercury

You have been given the task, by one of the partners of the firm of accountants for which you work, of assisting in the preparation of a trend statement for a client.

Mercury has been in existence for four years. Figures for the three preceding years are known but those for the fourth year need to be calculated. Unfortunately, the supporting workings for the preceding years’ figures cannot be found and the client’s own ledger accounts and workings are not available.

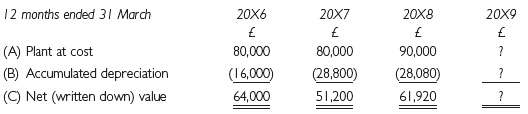

One item in particular, plant is causing difficulty and the following figures have been given to you:

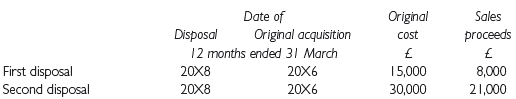

The only other information available is that disposals have taken place at the beginning of the financial years concerned:

Plant sold was replaced on the same day by new plant. The cost of the plant which replaced the first disposal is not known but the replacement for the second disposal is known to have cost £50,000.

Required:

(a) Identify the method of providing for depreciation on plant employed by the client, stating how you have arrived at your conclusion.

(b) Show how the figures shown at line (B) for each of the years ended 31 March 20X6, 20X7 and 20X8 were calculated. Extend your workings to cover the year ended 31 March 20X9.

(c) Produce the figures that should be included in the blank spaces on the trend statement at lines (A), (B) and (C) for the year ended 31 March 20X9.

(d) Calculate the profit or loss arising on each of the twodisposals.

12 months ended 31 March 20X7 20X8 20X6 20X9 80,000 (28,800) 51,200 90,000 (28,080) 61,920 (A) Plant at cost (B) Accumulated depreciation 80,000 (16,000) 64,000 (C) Net (written down) value ?

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

a Identifying the method The method of depreciation is the diminishing balance method The following ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

168-B-A-G-F-A (1081).docx

120 KBs Word File