Mollys Music is an independent record store located in Seattle, Washington. Molly, a self-described music junkie, started

Question:

Molly’s Music is an independent record store located in Seattle, Washington. Molly, a self-described “music junkie,” started her business after she encountered repeated difficulties finding music that was not produced by one of the major record labels. Molly wanted a store that had just about everything in stock, from the most popular artists to the most obscure artists in all musical genres, be it rock or roots. She also wanted a store that supported local musicians by carrying their CDs.

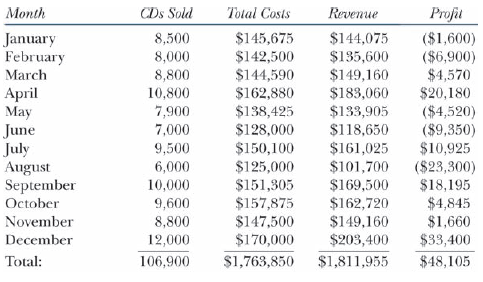

Albeit slowly, Molly has seen her business grow over the years and, on any given day, Molly’s 25,000 square-foot store has 75,000 titles in stock. Molly also has assembled an eclectic, knowledgeable staff that lives for music and can assist customers with just about any musical question or request. A review of Molly’s sales, costs, revenue, and profit data for the previous 12 months revealed the following:

While you find Molly’s proceeds from her business impressive, you believe that she could do better if she reduced the average selling price per CD. Specifically, over the past several years, you (as one of Molly’s employees) have heard numerous customers rave about Molly’s knowledgeable and courteous staff and vast array of CD titles.

However, you also have heard numerous customers say that Molly’s average price of $16.95 per CD is “unreasonable.” Moreover, you have witnessed individuals come into the store, ask for your advice, and then leave without making a purchase. Your supposition is that once these customers decide on the CDs they want, they actually buy their CDs from one of the local chain stores where the average price per CD is $14.95.

To be competitive with the chain stores, you believe that Molly should reduce the average selling price of a CD by $2.00 to $14.95. Based on your experience and an informal customer survey, you estimate that such a move would increase CD sales by 30%. You also believe that the increased sales volume would be well within Molly’s relevant range—that is, if sales increased by 30% Molly would not have to invest in additional fixed costs related to space, equipment, or personnel.

Molly believes that your idea is “nuts” because your recommended selling price is lower than the average cost per CD. Molly calculates that she would lose $14.95 - $16.50 = ($1.55) per CD if she followed your advice. Molly arrived at the $16.50 cost per CD by dividing her total costs for the most recent year, or $1,763,850, by the total number of CDs sold during the most recent year, or 106,900.

Required:

a. Before performing any calculations, prepare a brief paragraph or two discussing the soundness of Molly’s logic regarding her response to your suggested price decrease.

b. Help Molly better understand the “big picture” by plotting (i.e., graphing) the relation between her total costs and number of CDs sold (x - axis). Is this graph informative about Molly’s cost structure?

c. Using the high-low method, estimate Molly’s monthly cost equation (i.e., use the high-low method to estimate Molly’s monthly fixed costs and variable cost per CD sold). Add a line representing Molly’s estimated cost equation to your graph in part (b). Does your model appear to fit the data well?

d. Based on the cost model you developed in part (c), does it make sense for Molly to lower the selling price per CD to $14.95? That is, by how much do you estimate that Molly’s expected yearly profit will increase or decrease if she follows your advice?

e. Molly is impressed with your business acumen and wonders whether the cost model you developed can help her with another business decision. Specifically, Molly is considering hiring another employee at a total cost of $52,150 per year in salary and benefits. Molly believes that this employee, who is an expert in international folk music, will increase monthly sales by 750 CDs. Assuming Molly decides to reduce the average price of a CD to $14.95, by how much is Molly’s annual profit expected to increase or decrease if she hires this employee?

f. Molly has one final question for you. Ten years ago, she purchased 10 “Greatest Hits from the 70’s” CDs (Molly was a huge fan of KC and The Sunshine Band, and they are featured on the CD’s cover). Molly paid the record company $5 for each CD and priced them at $12.95 each. Molly sold six “Greatest Hits from the 70’s” CDs in the first three years after acquiring them; however, Molly has not sold any of the remaining four CDs in the last seven years (the CDs have been sitting on the shelf collecting dust).

Recently, one of Molly’s college-age customers offered to buy the four remaining CDs for $15. (The customer thinks they will make nice gifts for his older relatives.) Molly is reluctant to accept the offer because she paid $5 for each CD. Before declining, though, she asks you for your advice. What would you recommend to Molly? Why?

Step by Step Answer:

Managerial accounting

ISBN: 978-0471467854

1st edition

Authors: ramji balakrishnan, k. s i varamakrishnan, Geoffrey b. sprin