Mr. Marinos purchase of LifePath Fitness was done through his business. The investment has always been accounted

Question:

Mr. Marino’s purchase of LifePath Fitness was done through his business. The investment has always been accounted for using the cost method on his firm’s books. However, early in 2012 he decided to take his company public. He is preparing an IPO (initial public offering), and he needs to have the firm’s financial statements audited. One of the issues to be resolved is to restate the investment in LifePath Fitness using the equity method, since Mr. Marino’s ownership percentage is greater than 20%. Percentage is greater than 20%.

Instructions

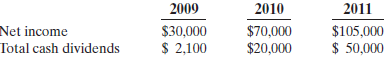

(1) Give the entries that would have been made on Marino’s books if the equity method of accounting for investments had been used since the initial investment. Assume the following data for LifePath.

(2) Compute the balance in the LifePath Investment account at the end of 2011.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso