Multinational firms, differing risk, comparison of profit, ROI and RI. Zzwuig Multinational, Inc. has divisions in the

Question:

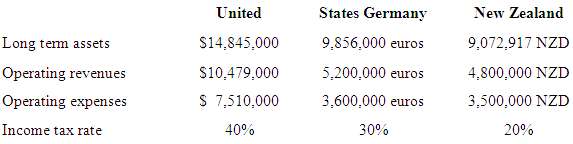

Multinational firms, differing risk, comparison of profit, ROI and RI. Zzwuig Multinational, Inc. has divisions in the United States, Germany, and New Zealand. The U.S. division is the oldest and most established of the three, and has a cost of capital of6%. The German division was started three years ago when the exchange rate for euros was 1 euro = $1.25. Although it is a large and powerful division of Zzwuig Inc., its cost of capital is 10%. The New Zealand division was started this year, when the exchange rate was 1 New Zealand Dollar (NZD) = $0.64. Its cost of capital is 13%. Average exchange rates for the current year are 1 euro ' $1.32 and 1 NZD = $0.67. Other information for the three divisions includes:

1. Translate the German and New Zealand information into dollars to make the divisions comparable. Find the after-tax operating income for each division and compare the profits.

2. Calculate ROI using after-tax operating income. Compare among divisions.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav