Question: Multiple Choice Questions 1. Onan indirect method statement of cash flows, a gain on the sale of plant assets would be a. Reported in the

Multiple Choice Questions

1. Onan indirect method statement of cash flows, a gain on the sale of plant assets would be

a. Reported in the investing activities section.

b. Added to net income in the operating activities section.

c. Deducted from net income in the operating activities section.

d. Ignored, since the gain did not generate any cash.

2. Select an activity for each of the following transactions:

1. Paying cash dividends is a/an activity.

2. Receiving cash dividends is a/an activity.

3. Click Camera Co. sold equipment with a cost of $21,000 and accumulated depreciation of $9,000 for an amount that resulted in a gain of $1,000. What amount should Click report on the statement of cash flows as proceeds from sale of plant assets?

a. $10,000

b. $20,000

c. $13,000

d. Some other amount

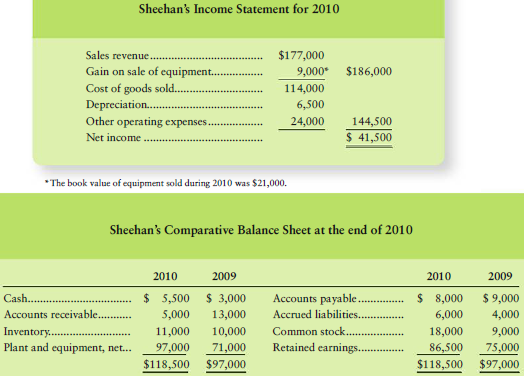

Questions 4-7 use the following data. Sheehan Corporation formats operating cash flows by the indirect method.

4. How many items enter the computation of Sheehan’s net cash provided by operating activities?

a. 3

b. 2

c. 7

d. 5

5. How do Sheehan’s accrued liabilities affect the company s statement of cash flows for 2010?

a. Increase in cash used by investing activities.

b. Increase in cash provided by operating activities.

c. Increase in cash used by financing activities.

d. They don t because the accrued liabilities are not yet paid.

6. How do accounts receivable affect Sheehan’s cash flows from operating activities for 2010?

a. Decrease in cash provided by operating activities.

b. Decrease in cash used by investing activities.

c. Increase in cash provided by operating activities.

d. They don t because accounts receivable result from investing activities.

7. Sheehan’s net cash provided by operating activities during 2010 was

a. $53,000.

b. $50,000.

c. $47,000.

d. $44,000.

Sheehan's Income Statement for 2010 Sales revenue. $177,000 9,000* $186,000 Gain on sale of equipment. Cost of goods sold. Depreciation. Other operating expenses.. Net income . 114,000 6,500 144,500 24,000 $ 41,500 *The book value of equipment sold during 2010 was $21,000. Sheehan's Comparative Balance Sheet at the end of 2010 2010 2009 2010 2009 $ 5,500 $ 3,000 13,000 10,000 $ 8,000 $ 9,000 4,000 Cash.. Accounts payable. Accounts receivable.. 5,000 Accrued liabilities. 6,000 Inventory.. Plant and equipment, net... 11,000 Common stock.. 18,000 9,000 Retained earnings.. 86,500 $118,500 97,000 71,000 75,000 $118,500 $97,000 $97,000

Step by Step Solution

3.44 Rating (170 Votes )

There are 3 Steps involved in it

1 c Deducted from net income in the operating activities section 2 Paying dividends financing ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

196-B-M-A-S-C-F (1585).docx

120 KBs Word File