Multiple choice questions 1. The market risk department of Trustworthy Bank reports a $5 million overnight VaR

Question:

Multiple choice questions

1. The market risk department of Trustworthy Bank reports a $5 million overnight VaR figure with 99.5 percent confidence level. The bank

(a) Can be expected to lose at most $5 million in 1 out of the next 100 days

(b) Can be expected to lose at least $5 million in 1 out of the next 200 days

(c) Can be expected to lose at most $2.5 million in 1 out of the next 100 days

(d) Can be expected to lose at most $5 million in 1 out of the next 200 days

2. Given two portfolios, X and Y, whose returns are bivariate normal (implying that returns on portfolios of them are also normally distributed), do we have:

(a) VaR(X) + VaR(Y) ≤ VaR(X + Y)?

(b) VaR(X) + VaR(Y) = VaR(X + Y)?

(c) VaR(X) + VaR(Y) ≥ VaR(X + Y)?

(d) None of the above?

3. Drop the normality from the preceding question. So, given two portfolios, X and Y, do we have:

(a) VaR(X) + VaR(Y) ≤ VaR(X + Y)?

(b) VaR(X) + VaR(Y) = VaR(X + Y)?

(c) VaR(X) + VaR(Y) ≥ VaR(X + Y)?

(d) None of the above?

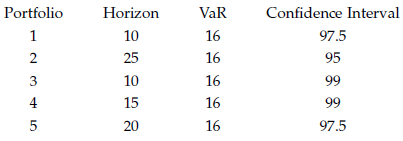

4. Which of the following portfolios is the most risky? Assume 240 trading days per year and 5 trading days a week.

Step by Step Answer:

International Finance Putting Theory Into Practice

ISBN: 978-0691136677

1st edition

Authors: Piet Sercu