Question: Multiple-Choice Questions 1. The primary difference between control accounts and subsidiary accounts is that a. control accounts appear on the balance sheet but subsidiary accounts

Multiple-Choice Questions

1. The primary difference between control accounts and subsidiary accounts is that a. control accounts appear on the balance sheet but subsidiary accounts appear on the income statement.

b. subsidiary accounts provide detailed information; control accounts provide summary information.

c. control account balances are reported on the financial statements but subsidiary accounts appear only in the general ledger.

d. subsidiary accounts are necessary in a manual accounting system but not in a computerized system.

2. At the beginning of the year, Lagos Importers had $750 of office supplies on hand. During the year, an additional $3,250 of supplies were purchased and recorded in Office Supplies Inventory. At year end, $900 of supplies remained on hand. Just prior to preparing the year-end adjusting entry, the balance in the Office Supplies Inventory account was $1,200. Which of the following is a true statement about the necessary adjusting entry?

a. An asset account must be decreased by $300.

b. An asset account must be decreased by $3,250.

c. An expense account must be increased by $1,200.

d. An expense account must be increased by $900.

3. The balance of the merchandise inventory account increased by $3,000 during February. Which of the following statements can be made as a result of this information?

a. Credit sales for the month were $3,000 greater than cash received from customers. b. Purchases of inventory for the month were $3,000 less than the cost of merchandise sold for the month.

c. Purchases of inventory for the month were $3,000 greater than the cost of merchandise sold for the month.

d. Merchandise purchased for the month totaled $3,000.

4. Which of the following accounts should always have a zero balance after all closing entries are completed?

a. Interest Expense

b. Interest Payable

c. Prepaid Interest

d. Accounts Payable

5. Tempel Manufacturing uses accrual accounting. Each of the following events occurred during the month of February. Which one of them should be recorded as a revenue or expense for the month of February?

a. Sales of $30,000 were made on credit. They will be collected during March.

b. Collections of $10,000 were made from sales that occurred during January.

c. Materials costing $18,000 were purchased and paid for. It is expected that they will be used during March.

d. A bill in the amount of $8,600 was received from a supplier for goods purchased during January. It was paid immediately.

6. Zinsli Company uses the accrual basis of accounting. Each of the following events occurred during July. Which one of them should be reported as an expense for July?

a. Office supplies costing $800 were used up. They had been purchased and paid for during April.

b. A new delivery truck was purchased on the last day of July. It was not put into use until August.

c. On the third day of the month, $8,000 was paid to employees for hours worked during the month of June.

d. Near the end of the month, August’s rent of $1,500 was paid in advance.

7. The following information is available for two companies for the year 2004:

.png)

Which of the following statements can be determined from the information provided?

a. Pencil-Thin collected more cash from customers during 2004 than did Handle-Bar.

b. Pencil-Thin was profitable during 2004, whereas Handle-Bar may have been profitable.

c. Pencil-Thin was twice as profitable as Handle-Bar.

d. Handle-Bar consumed more total resources during 2004 than did Pencil-Thin.

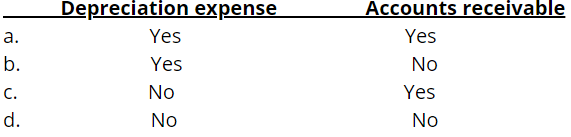

8. Are the following accounts a liability?

9. Using accrual-basis measurement, expenses should be recognized when

a. A business owner recognizes that the firm is generating too much profit.

b. Resources are used rather than when they are paid for.

c. Cash is paid for resources.

d. Sufficient revenue is earned to offset the expenses.

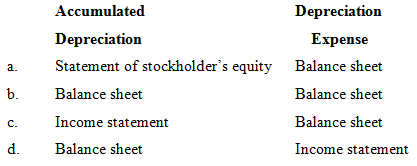

10. Match the account name to the financial statement on which it is reported.

Handle-Bar Mustache Co. Cash Operating Statement For the Year 2001 $50,000 38,000 $12,000 Pencil-Thin Mustache Co. Accrual Income Statement For the Year 2004 $55,000 Receipts/Revenues Payments/Expenses Net Cash/Net Income

Step by Step Solution

3.29 Rating (161 Votes )

There are 3 Steps involved in it

1 b Subsidiary accounts provide detailed information control accounts provide s... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

157-B-A-I-S (1185).docx

120 KBs Word File