Musselwhite Independent School District (ISD) began construction of a new building (for McCoin Middle School) during its

Question:

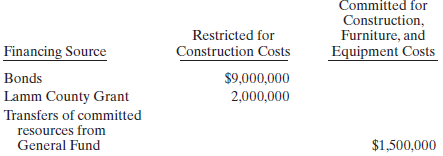

Musselwhite Independent School District (ISD) began construction of a new building (for McCoin Middle School) during its 20X1 fiscal year, which ended April 30, 20X1. The plan for financing the construction of the facility was:

During fiscal year 20X0–20X1:

• The $2,000,000 restricted grant from the county was received and used to begin construction.

• The full amount of the grant was recognized as revenue.

• The bonds were issued, generating $9,000,000 of cash for the project late in the fiscal year. No General Fund money was transferred to the McCoin Middle School Capital Projects Fund in this fiscal year.

• Total construction costs incurred during 20X0–20X1 were $3,500,000. Restricted Fund Balance of $7,500,000 was reported in the balance sheet of the McCoin Middle School CPF at April 30, 20X1.

During the 20X1–20X2 fiscal year:

• The Musselwhite ISD transferred $1,500,000—committed by a resolution of the school board in accordance with its commitments policy—from the ISD’s General Fund to its McCoin Middle School CPF. The cash was committed to construction costs and/or furniture and equipment purchases for the middle school.

• The district’s finance director later transferred $300,000 of unrestricted, uncommitted cash from the General Fund to the CPF to finance landscaping of the school site and $50,000 to be used for purchases of furniture and equipment. The finance director was authorized by the board to determine the amount that the county could afford for these purposes in 20X1–20X2 and approve the transfer. The ISD expects the total cost of landscaping to exceed the amount transferred but cannot transfer more during 20X1–20X2 because of budget constraints.

• Construction was completed in April 20X2. Construction expenditures incurred during 20X1–20X2 to complete the middle school totaled $7,680,000 because of unexpected cost overruns.

• $1,000,000 of furniture and equipment was ordered and received. Encumbrances outstanding for orders placed for furniture and equipment, but not yet filled, totaled $552,000.

• Landscaping expenditures incurred were $158,000, but a contract was signed for $95,400 of additional landscaping work to be completed before the school opens in September 20X2. $20,000 of the landscaping expenditures was for landscaping materials purchased by the ISD and is still on hand at April 30.

Required

a. Prepare a schedule (or schedules) computing the balances that Musselwhite ISD should report in each category of fund balance in the balance sheet of its McCoin Middle School CPF. Musselwhite ISD’s policy related to restricted assets is that restricted financial resources for a certain purpose are expended for the restricted purpose before unrestricted resources are expended. The board does not have a spend-down policy for unrestricted resources.

b. Prepare the fund balance section of the McCoin Middle School CPF balance sheet at April 30, 20X2.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Governmental and Nonprofit Accounting Theory and Practice

ISBN: 978-0133799569

11th edition

Authors: Robert J. Freeman, Craig D. Shoulders, Dwayne N. McSwain, Robert B. Scott