Question: Nicks Novelties, Inc., is considering the purchase of electronic pinball machines to place in amusement houses. The machines would cost a total of $300,000, have

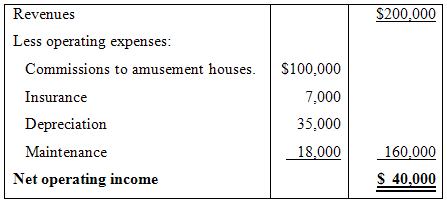

Nick’s Novelties, Inc., is considering the purchase of electronic pinball machines to place in amusement houses. The machines would cost a total of $300,000, have an eight-year useful life, and have a total salvage value of $20,000. The company estimates that annual revenues and expenses associated with the machines would be as follows:

Required:

1. Assume that Nick’s Novelties, Inc., will not purchase new equipment unless it provides a payback period of five years or less. Would the company purchase the pinball machines?

2. Compute the simple rate of return promised by the pinball machines. If the company requires a simple rate of return of at least 12%, will the pinball machines be purchased?

$200,000 Revenues Less operating expenses: Commissions to amusement houses. s100,000 Insurance 7,000 Depreciation 35,000 18,000 Maintenance 160,000 S 40.000 Net operating income

Step by Step Solution

3.33 Rating (180 Votes )

There are 3 Steps involved in it

1 Computation of the annual cash inflow associated wi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-C-B-D (21).docx

120 KBs Word File