An oil company plans to purchase a piece of vacan1 land on the comer of two busy

Question:

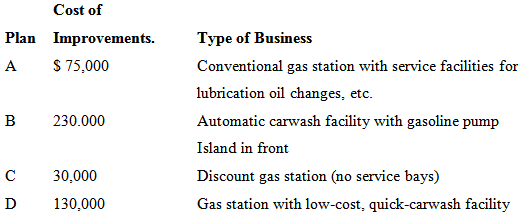

An oil company plans to purchase a piece of vacan1 land on the comer of two busy streets for $70,000. On properties of this type, the company installs businesses of four different types.

*Cost of improvements does not include the $70,000 cost of land.

In each case, the estimated useful life of the improvements is 15 years. The salvage value for each is estimated to be the $70,000 cost of the land. The net annual income, after paying all operating expenses, is projected as follows:

Plan Net Annual Income

A..........................................$23,300

B...........................................44,300

C...........................................10,000

D...........................................27,500

If the oil company expects a 10% rate of return on its investments, which plan (if any) should be selected?

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer: