On January 1, 2010, Diana Peter Company has the following defined benefit pension plan balances. Defined benefit

Question:

On January 1, 2010, Diana Peter Company has the following defined benefit pension plan balances.

Defined benefit obligation..........................................................€4,200,000

Fair value of plan assets................................................................4,200,000

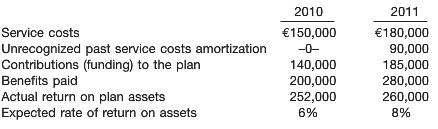

The discount rate applicable to the plan is 10%. On January 1, 2011, the company amends its pension agreement so that past service costs of €500,000 are created. Other data related to the pension plan are as follows.

Instructions

(a) Prepare a pension worksheet for the pension plan for 2010 and 2011.

(b) As of December 31, 2011, prepare a schedule reconciling the funded status with the reported liability.

Discount RateDepending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470616314

IFRS edition volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield