On January 1, 2011, Vair, a Canadian company, acquired all the shares of Logan, a company in

Question:

On January 1, 2011, Vair, a Canadian company, acquired all the shares of Logan, a company in Brazil, at which date the equity and liability sections of Logan's statement of financial position showed the following balances in reals (BRL):

Share capital (300,000 shares) ....300,000

Retained earnings ........ 40,000

Other components of equity ..... 30,000

Dividend payable ......... 20,000

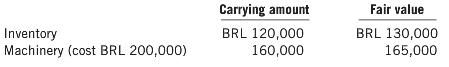

On January 1, 2011, all the identifiable assets and liabilities of Logan were recorded at fair value except for:

The inventory was all sold by October 2011. The machinery had a further five-year life but was sold on June 30, 2013. On December 31, 2013, the trial balances of Vair and Logan were as follows:

-2.png)

Additional information:

1. On January 1, 2012, Vair sold an item of plant to Logan at a profit before tax of $4,000. Vair depreciates this particular item of plant straight line over five years and Logan depreciates straight line over 10 years.

2. At December 31, 2013, Vair had on hand some items of inventory purchased from Logan in June 2013 at a profit of BRL 500. The sales were BRL 1,000 and the cost of sales was BRL 500.

3. Vair charged a management fee of BRL 2,000 per month to Logan. As at year end, Logan had not paid the fee for three months.

4. The tax rate is 30%.

5. The following exchange rates exist:

January 1, 2011 ..........BRL 1 = C$0.533

December 31, 2011 ......... BRL 1 = C$0.56

December 31, 2012 ......... BRL 1 = C$0.59

December 31, 2013 ......... BRL 1 = C$0.64

Average 2011-2013 ......... BRL 1 = C$0.70

6. The retained earnings of BRL 42,000 at January 1, 2013 and the other components of equity of BRL 70,000 at January 1, 2013 accumulated at the rate of C$0.67.

7. Dividends were declared on the last day of the year.

Required

(a) Translate the financial statements of Logan in preparation for the consolidation with Vair. Vair will be presenting in Canadian dollars.

(b) Calculate the adjustments for the consolidated financial statements for the year ending December 31, 2013.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: