On July 1, 2013, the FHLMC 30-Year Generic 4% 2012 was analyzed using the Monte Carlo valuation

Question:

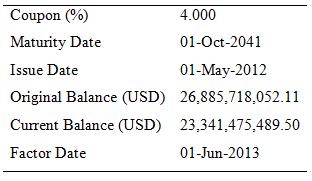

On July 1, 2013, the FHLMC 30-Year Generic 4% 2012 was analyzed using the Monte Carlo valuation model of FactSet. At the time of the analysis the security’s price was 104.644 with accrued interest of 0.300 (per $100 par value). Summary information about the security is as follows:

The results of a simulation using 200 interest-rate path are reproduced as follows:

YTM (%) | 2.981 |

Average Life | 5.307 |

Modified Duration | 4.551 |

Effective Duration | 4.135 |

Effective Convexity | –1.905 |

Partial Duration—6 Month | –0.088 |

Partial Duration—1 Year | 0.097 |

Partial Duration—2 Year | 0.516 |

Partial Duration—5 Year | 1.500 |

Partial Duration—10 Year | 1.806 |

Partial Duration—30 Year | 0.304 |

Spread Duration | 4.338 |

Spread (TRSY) | 1.585 |

Z-Spread | 97.232 |

OAS (TRSY) | 95.158 |

OAS (Libor) | 77.909 |

Projected CPR (PB WAVG) | 14.870 |

Projected PSA (PB WAVG) | 278.342 |

(a) Explain the meaning of each of the measures above.

(b) Given the computed convexity measure, how is this pass-through security expected to perform compared to a comparable Treasury security if the term structure of Treasury rates decreases substantially in a parallel fashion?

Step by Step Answer: