Question: On May 1, Jeff Wilkins started Skyline Flying School, a company that provides flying lessons, by investing $45,000 cash in the business. Following are the

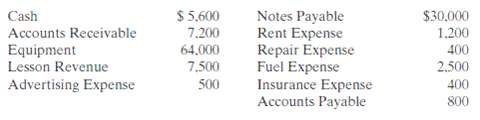

On May 1, Jeff Wilkins started Skyline Flying School, a company that provides flying lessons, by investing $45,000 cash in the business. Following are the assets and liabilities of the company on May 31, 2010, and the revenues and expenses for the month of May.

Jeff Wilkins made no additional investment in May, but he withdrew $1,500 in cash for personal use.Instructions(a) Prepare an income statement and owner's equity statement for the month of May and a balance sheet at May 31.(b) Prepare an income statement and owner's equity statement for May assuming the following data are not included above: (1) $900 of revenue was earned and billed but not collected at May 31, and (2) $1,500 of fuel expense was incurred but notpaid.

Notes Payable Rent Expense Repair Expense Fuel Expense Insurance Expense Accounts Payable Cash Accounts Receivable Equipment Lesson Revenue Advertising Expense $30,000 1.200 400 2.500 400 800 $5,600 7.200 64,000 7.500 500

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

a SKYLINE FLYING SCHOOL Income Statement For the Month Ended May 31 2010 Revenues Lesson revenue 750... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-A-A-C (104).docx

120 KBs Word File