One measure of the effective tax rate is the difference between the IRRs of pretax and after

Question:

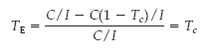

One measure of the effective tax rate is the difference between the IRRs of pretax and after tax cash flows, divided by the pretax IRR. Consider, for example, an investment I generating a perpetual stream of pretax cash flows C. The pretax IRR is C/I, and the after-tax IRR is C(1 ? Tc)/I, where Tc is the statutory tax rate. The effective rate, call it TE, is

In this case the effective rate equals the statutory rate.

a. Calculate TE for the guano project in Section 6.2.

b. How does the effective rate depend on the tax depreciation schedule On the inflation rate?

c. Consider a project where all of the up-front investment is treated as an expense for tax purposes. For example, R&D and marketing outlays are always expensed in the U.S. They create no tax depreciation. What is the effective tax rate for such aproject?

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers