Question: (One Temporary Difference, Tracked 3 Years, Change in Rates, Income Statement Presentation) Crosley Corp. sold an investment on an installment basis. The total gain of

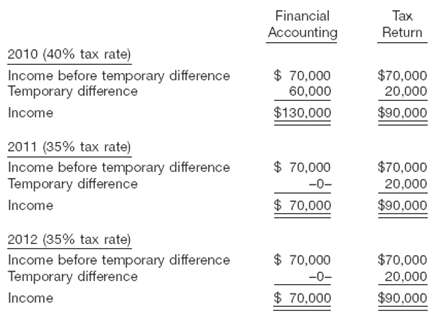

(One Temporary Difference, Tracked 3 Years, Change in Rates, Income Statement Presentation) Crosley Corp. sold an investment on an installment basis. The total gain of $60,000 was reported for financial reporting purposes in the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years; one-third of the sale price is collected in the period of sale. The tax rate was 40% in 2010, and 35% in 2011 and 2012. The 35% tax rate was not enacted in law until 2011. The accounting and tax data for the 3 years is shown below.

(a) Prepare the journal entries to record the income tax expense, deferred income taxes, and the income tax payable at the end of each year. No deferred income taxes existed at the beginning of 2010.

(b) Explain how the deferred taxes will appear on the balance sheet at the end of each year. (Assume the Installment Accounts Receivable is classified as a current asset.)

(c) Draft the income tax expense section of the income statement for each year, beginning with 'Income before incometaxes.'?

2010 (40% tax rate) Income before temporary difference Temporary difference Income 2011 (35% tax rate) Income before temporary difference Temporary difference Income 2012 (35% tax rate) Income before temporary difference Temporary difference Income Financial Accounting $70,000 60,000 $130,000 $ 70,000 -0- $ 70,000 $ 70,000 -0- $70,000 Tax Return $70,000 20,000 $90,000 $70,000 20,000 $90,000 $70,000 20,000 $90,000

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

a Before deferred taxes can be computed the amount of cumulative tem porary difference existing at the end of each year must be computed Pretax financial income Taxable income Temporary difference ori... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-I-T (83).docx

120 KBs Word File