Question: OReilly Company lost all of its inventory in a fire on December 26, 2010. The accounting records showed the following gross profit data for November

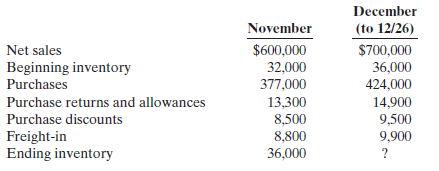

O’Reilly Company lost all of its inventory in a fire on December 26, 2010. The accounting records showed the following gross profit data for November and December.

O’Reilly is fully insured for fire losses but must prepare a report for the insurance company.

Instructions

(a) Compute the gross profit rate for November.

(b) Using the gross profit rate for November, determine the estimated cost of the inventory lost in the fire.

December (to 12/26) November Net sales Beginning inventory Purchases Purchase returns and allowances Purchase discounts $600,000 32,000 377,000 13,300 8,500 8,800 $700,000 424,000 14,900 9,500 9,900 ? Freight-in Ending inventory 36,000

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

a November Net sales 600000 Cost of goods sold Beginning inventory 32000 Purchases 377000 Less Purch... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-M-A-I (75).docx

120 KBs Word File