Question: Otobai is considering still another production method for its electric scooter. It would require an additional investment of 15 billion but would reduce variable costs

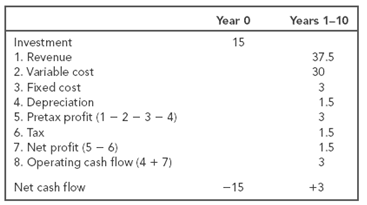

Otobai is considering still another production method for its electric scooter. It would require an additional investment of ¥15 billion but would reduce variable costs by ¥40,000 per unit. Other assumptions follow Table 10.1.

a. What is the NPV of this alternative scheme?

b. Draw break-even charts for this alternative scheme along the lines of Figure 10.1.

c. Explain how you would interpret the break-even figure. Now suppose Otobai’s management would like to know the figure for variable cost per unit at which the electric scooter project in Section 10.1 would break even. Calculate the level of costs at which the project would earn zero profit and at which it would have zero NPV.

Years 1-10 Year o Investment 15 1. Revenue 37.5 2. Variable cost 30 3. Fixed cost 4. Depreciation 5. Pretax profit (1 2 3 4) 6. Tax 7. Net profit (5 6) 8. Operating cash flow (4 + 7) 1.5 1.5 1.5 3 Net cash flow -15 +3

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

a b Note that the breakeven point can be found algebraically as follows Set NPV equal to ze... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-C-B (124).docx

120 KBs Word File