Pan Li Ltd. is a Canadian private corporation owned 100% by David Benjamin. The corporation operates an

Question:

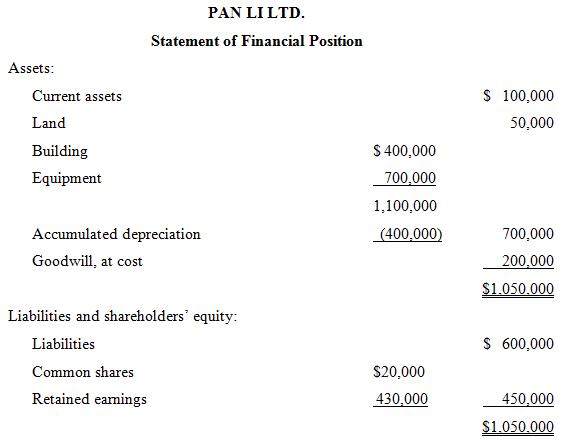

Pan Li Ltd. is a Canadian private corporation owned 100% by David Benjamin. The corporation operates an active business. Its most recent statement of financial position is summarized in the table below.

Benjamin purchased the shares of Pan Li seven years ago from the previous shareholders at a cost of $100,000. He is considering retirement and has let it be known that the business is for sale. Recently, he received an offer of $700,000 for the shares of the corporation.

A second potential group of buyers has indicated that it would like to buy the business but does not want to buy the shares of the corporation. Instead, it wants to purchase the individual assets (current assets, land, building, equipment, and goodwill). Benjamin knows that certain of the corporate assets are worth more than their stated value on the financial statement and has asked his advisor to provide an appraisal. If he sold to the asset-buying group, the buyers would assume the corporation’s liabilities of $600,000 as part of the purchase price.

Both potential buyers have indicated that they have sufficient cash resources to pay only 70% of the purchase price and that the remaining 30% will have to be paid over three years, with appropriate interest.

Benjamin does not understand the tax implications of selling the shares, rather than the assets. Once the business is sold, he intends to use the funds to buy investments that will provide an annual return to supplement his retirement income.

Required:

1. Keeping in mind Benjamin’s objectives, explain to him the general tax implications of selling the shares of Pan Li, rather than the company’s individual assets.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold