Par Corporation acquired an 80 percent interest in Sam Corporation common stock for $240,000 on January 1,

Question:

Par Corporation acquired an 80 percent interest in Sam Corporation common stock for $240,000 on January 1, 2010, when Sam's stockholders' equity consisted of $200,000 common stock, $100,000 preferred stock, and $25,000 retained earnings. The excess was due to goodwill.

Intercompany sales of inventory items from Par to Sam were $50,000 in 2010 and $60,000 in 2011. The cost of these items to Par was 60 percent of the selling price to Sam, and Sam inventoried $30,000 of the intercompany sales items at December 31, 2010, and $40,000 at December 31, 2011. Intercompany receivables and payables from these sales were $10,000 at December 31, 2010, and $5,000 at December 31, 2011.

Sam sold land that cost $10,000 to Par for $20,000 during 2010. During 2011, Par resold the land outside the consolidated entity for $30,000.

On July 1, 2011, Par purchased all of Sam's bonds payable in the open market for $91,000.

These bonds were issued at par, have interest payment dates of June 30 and December 31, and mature on June 30, 2014.

Sam declared and paid dividends of $10,000 on its cumulative preferred stock and $10,000 on its common stock in each of the years 2010 and 2011.

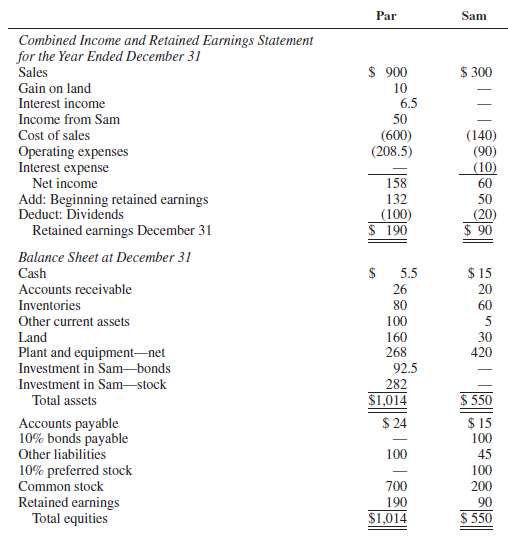

Financial statements for Par and Sam Corporations at and for the year ended December 31, 2011, are summarized as follows (in thousands):

REQUIRED: Prepare a consolidation workpaper for Par Corporation and Subsidiary for the year ended December 31,2011.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith