Pea Corporation purchased 75 percent of the outstanding voting stock of Sen Corporation for $2,400,000 on January

Question:

Pea Corporation purchased 75 percent of the outstanding voting stock of Sen Corporation for $2,400,000 on January 1, 2011. Sen's stockholders' equity on this date consisted of the following (in thousands):

Capital stock, $10 par........$1,000

Additional paid-in capital........ 600

Retained earnings December 31, 2010... 800

Total stockholders' equity.......$2,400

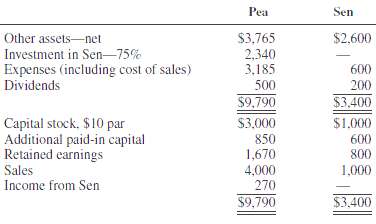

The excess fair value of the net assets acquired was assigned 10 percent to undervalued inventory (sold in 2011), 40 percent to undervalued plant assets with a remaining useful life of eight years, and 50 percent to goodwill. Comparative trial balances of Pea Corporation and Sen Corporation at December 31, 2015, are as follows:

REQUIRED: Determine the amounts that would appear in the consolidated financial statements of Pea Corporation and Subsidiary for each of the following items:1. Goodwill at December 31, 20152. Noncontrolling interest share for 20153. Consolidated retained earnings at December 31, 20144. Consolidated retained earnings at December 31, 20155. Consolidated net income for 20156. Noncontrolling interest at December 31, 20147. Noncontrolling interest at December 31,2015

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith