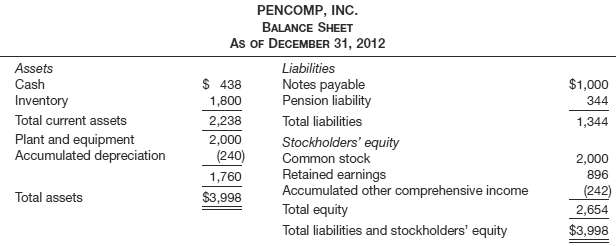

PENCOMP??s balance sheet at December 31, 2012, is as follows. Additional information concerning PENCOMP??s defined benefit pension

Question:

PENCOMP??s balance sheet at December 31, 2012, is as follows.

Additional information concerning PENCOMP??s defined benefit pension plain is as follows.Projected benefit obligation at 12/31/12 ........ $ 820.5Plan assets (fair value) at 12/31/12 ........... 476.5Unamortized past service cost at 12/31/12 ........ 150.0Amortization of past service cost during 2013 ....... 15.0Service cost for 2013 ................... 42.0Discount rate .................... 10%Expected rate of return on plan assets in 2013 ........ 12%Actual return on plan assets in 2013 ............ 10.4Contributions to pension fund in 2013 ........... 70.0Benefits paid during 2013 ............... 40.0Unamortized net loss due to changes in actuarial assumptions and deferred net losses on plan assets at 12/31/12 ...... 92.0Expected remaining service life of employees ......... 15.0Average period to vesting of prior service costs ....... 10.0Other information about PENCOMP is as follows.Salary expense, all paid with cash during 2013 ....... $ 700.0Sales, all for cash .................. 3,000.0Purchases, all for cash ................ 2,000.0Inventory at 12/31/13 ................. 1,800.0Property originally cost $2,000 and is depreciated on a straight-line basis over 25 years with no residual value.Interest on the note payable is 10% annually and is paid in cash on 12/31 of each year.Dividends declared and paid are $200 in 2013.AccountingPrepare an income statement for 2013 and a balance sheet as of December 31, 2013. Also, prepare the pension expense journal entry for the year ended December 31, 2013. Round to the nearest tenth (e.g., round 2.87 to 2.9)AnalysisCompute return on equity for PENCOMP for 2013 (assume stockholders?? equity is equal to year-end average stockholders?? equity). Do you think an argument can be made for including some or even all of the change in accumulated other comprehensive income (due to pensions) in the numerator of return on equity? Illustrate that calculation.PrinciplesExplain a rationale for why the FASB has (so far) decided to exclude from the current period income statement the effects of pension plan amendments and gains and losses due to changes in actuarialassumptions.

Step by Step Answer: