Question: Prepare the cash flow statement under the direct format for Michael Hart Associates using the data provided in E22-7. In E22-7 Michael Hart Associates closed

Prepare the cash flow statement under the direct format for Michael Hart Associates using the data provided in E22-7.

In E22-7

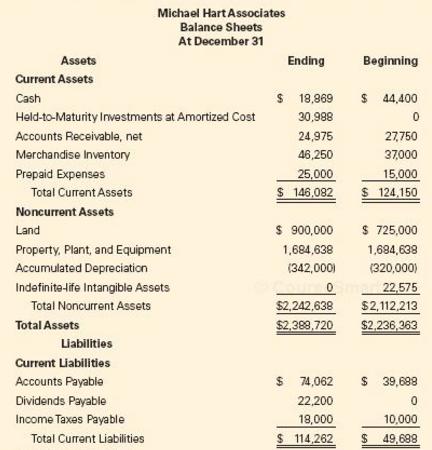

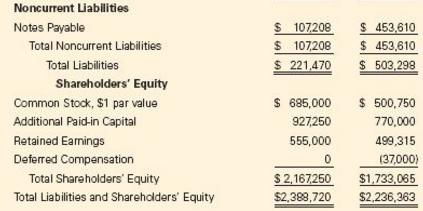

Michael Hart Associates closed its books for the current year. The firm provided the following comparative balance sheets and income statement.

Michael Hart Associates

Income Statement

For the Year Ended December 31

Current Year

Sales…………………………………………… $ 795,000

Cost of Goods Sold……………………………. 477,000

Gross Profit…………………………………….. $ 318,000

Selling, General, and Administrative Expenses… $ 83,250

Bad Debt Expense………………………………. 8,000

Depreciation Expense…………………………… 22,000

Total Operating Expenses……………………….. $ 113,250

Income before Interest and Taxes……………….. $ 204,750

Interest Expense…………………………………. $ (7,369)

Dividend Income………………………………… 1,650

Income Before Tax………………………………. $ 199,031

Income Tax Expense…………………………….. (79,612)

Net Income………………………………………. $ 119,419

Michael HartAssociates Balance Sheets At December 31 Ending Beginning $ 18,869 44,400 Held-to-Maturity Investments at Amortized Cost Accounts Receivable, net Merchandise Inventory 30,998 24,975 46,250 27750 37000 25,000 15,000 S 146.082 124,150 Total Current Assets Noncurrent Assets S 900,000 Property, Plant, and Equipment Accumulated Depreciation Indefinite-life Intangible Assets 1.684638 (342,0001 725,000 1684,638 20,000) Total Noncurrent Assets $2,242,638 $2,112,213 Total Assets 52.388 720 2 236,363 Liabilities Accounts Payable $ 74,062 39,688 18,000 S 114,262 10,000 49,688 Income Taxes Payable Total Current Liabilities Noncurrent Liabilities Notes Payable $ 107208 453,610 S 107208 S453,610 $ 221,470 503,298 Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital Retained Earnings Deferred Compensation S 685,000 500,750 770,000 499,315 37000) $ 2,167,250 S1,733,065 $2,388,720 $2,236,363 927250 555,000 Total Shareholders Equity Total Liabilities and Shareholders Equity

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

The first step in the solution is to isolate all balance sheet changes and classify the changes as operating investing or financing Analysis of Balance Sheet Changes and Cash Flow Classification Asset... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1970).docx

120 KBs Word File