Question: Presented below and on the next page is the balance sheet of Rasheed Brothers Corporation (000s omitted). InstructionsEvaluate the balance sheet presented. State briefly the

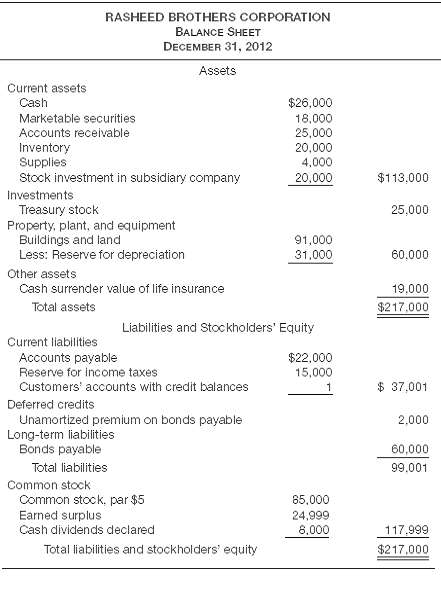

Presented below and on the next page is the balance sheet of Rasheed Brothers Corporation (000s omitted).

InstructionsEvaluate the balance sheet presented. State briefly the proper treatment of any itemcriticized.

RASHEED BROTHERS CORPORATION BALANCE SHEET DECEMBER 31, 2012 Assets Current assets $26,000 Cash Marketable securities 18,000 25,000 20,000 4,000 Accounts receivable Inventory Supplies Stock investment in subsidiary company 20,000 $113,000 Investments Treasury stock Property, plant, and equipment Buildings and land Less: Reserve for depreciation 25,000 91,000 31,000 60,000 Other assets Cash surrender value of life insurance 19,000 Total assets $217.000 Liabilities and Stockholders' Equity Current liabilities Accounts payable $22,000 15,000 1. Reserve for income taxes $ 37,001 Customers' accounts with credit balances Deferred credits Unamortized premium on bonds payable Long-term liabilities Bonds payable 2,000 60,000 Total liabilities 99.001 Common stock Common stock, par $5 Earned surplus 85,000 24,999 8,000 Cash dividends declared 117,999 $217,000 Total liabilities and stockholders' equity

Step by Step Solution

3.35 Rating (170 Votes )

There are 3 Steps involved in it

Criticisms of the balance sheet of the Rasheed Brothers Corporation 1 The basis for the valuation of marketable securities should be shown Marketable ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-T-V-M (141).docx

120 KBs Word File