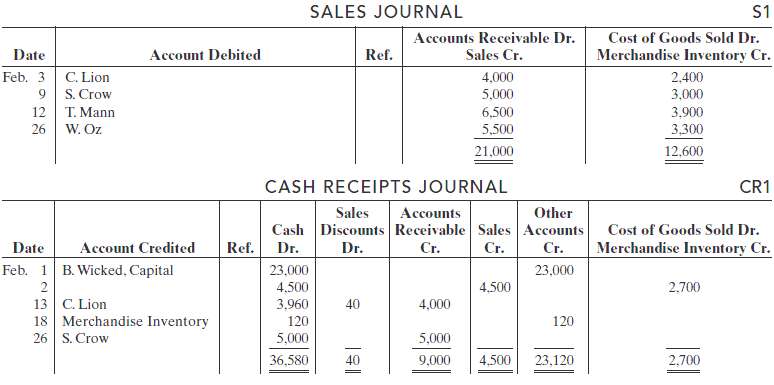

Presented below are the sales and cash receipts journals for Wicked Co. for its first month of

Question:

Presented below are the sales and cash receipts journals for Wicked Co. for its first month of operations.

In addition, the following transactions have not been journalized for February 2010.Feb. 2 Purchased merchandise on account from J. Garland for $3,600, terms 2/10, n/30.7 Purchased merchandise on account from B. Lahr for $23,000, terms 1/10, n/30.9 Paid cash of $980 for purchase of supplies.12 Paid $3,528 to J. Garland in payment for $3,600 invoice, less 2% discount.15 Purchased equipment for $5,500 cash.16 Purchased merchandise on account from D. Gale $1,900, terms 2/10, n/30.17 Paid $22,770 to B. Lahr in payment of $23,000 invoice, less 1% discount.20 B.Wicked withdrew cash of $800 from business for personal use.21 Purchased merchandise on account from Kansas Company for $6,000, terms 1/10, n/30.28 Paid $1,900 to D. Gale in payment of $1,900 invoice.Instructions(a) Open the following accounts in the general ledger.101 Cash 120 Merchandise Inventory112 Accounts Receivable 126 Supplies157 Equipment 401 Sales158 Accumulated Depreciation'Equipment 414 Sales Discounts201 Accounts Payable 505 Cost of Goods Sold301 B.Wicked, Capital 631 Supplies Expense306 B.Wicked, Drawing 711 Depreciation Expense(b) Journalize the transactions that have not been journalized in a one-column purchases journal and the cash payments journal (see Illustration 7-16).(c) Post to the accounts receivable and accounts payable subsidiary ledgers. Follow the sequence of transactions as shown in the problem.(d) Post the individual entries and totals to the general ledger.(e) Prepare a trial balance at February 28, 2010.(f) Determine that the subsidiary ledgers agree with the control accounts in the general ledger.(g) The following adjustments at the end of February are necessary.(1) A count of supplies indicates that $200 is still on hand.(2) Depreciation on equipment for February is $150.Prepare the adjusting entries and then post the adjusting entries to the general ledger.(h) Prepare an adjusted trial balance at February 28,2010.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso