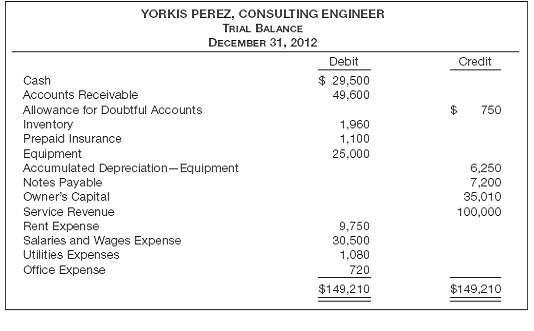

Question: Presented below are the trial balance and the other information related to Yorkis Perez, a consulting engineer. 1. Fees received in advance from clients $6,000.2.

Presented below are the trial balance and the other information related to Yorkis Perez, a consulting engineer.

1. Fees received in advance from clients $6,000.2. Services performed for clients that were not recorded by December 31, $4,900.3. Bad debt expense for the year is $1,430.4. Insurance expired during the year $480.5. Equipment is being depreciated at 10% per year.6. Yorkis Perez gave the bank a 90-day, 10% note for $7,200 on December 1, 2012.7. Rent of the building is $750 per month. The rent for 2012 has been paid, as has that for January 2013.8. Office salaries and wages earned but unpaid December 31, 2012, $2,510.Instructions(a) From the trial balance and other information given, prepare annual adjusting entries as ofDecember 31, 2012. (Omit explanations.)(b) Prepare an income statement for 2012, a statement of owner's equity, and a classified balance sheet. Yorkis Perez withdrew $17,000 cash for personal use during theyear.

YORKIS PEREZ, CONSULTING ENGINEER TRIAL BALANCE DECEMBER 31, 2012 Debit $ 29,500 49,600 Credit Cash Accounts Receivable Allowance for Doubtful Accounts 750 Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Notes Payable Owner's Capital 1,960 1,100 25,000 6,250 7,200 35,010 100,000 Service Revenue Rent Expense Salaries and Wages Expense Utilities Expenses Office Expense 9,750 30,500 1,080 720 $149,210 $149,210

Step by Step Solution

3.40 Rating (169 Votes )

There are 3 Steps involved in it

a 1 Service Revenue 6000 Unearned Service Revenue 6000 2 Accounts Receivable 4900 Service Revenue 49... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-I-S (188).docx

120 KBs Word File